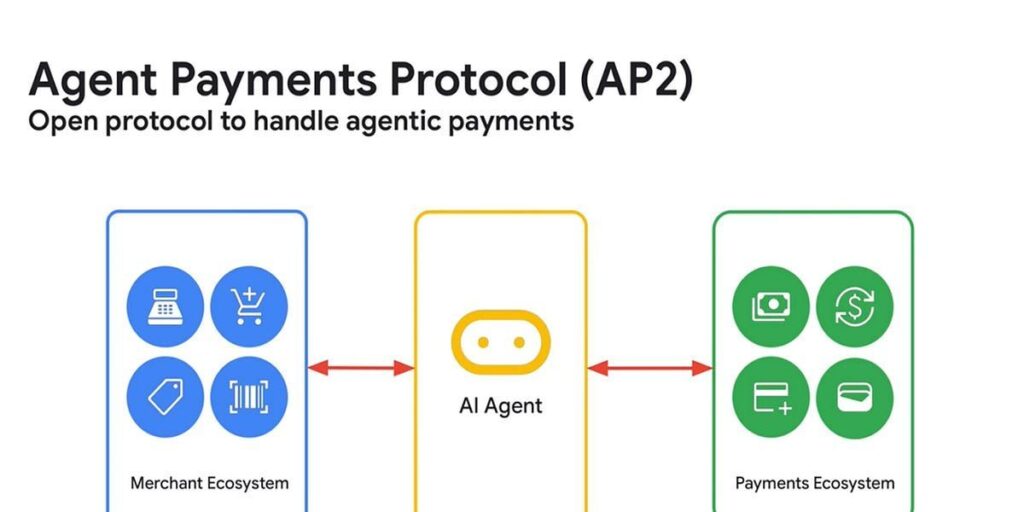

Google is once again positioning itself at the forefront of technological innovation. The tech giant has announced Agent Protocol 2 (AP2), a new framework designed to integrate artificial intelligence into payment systems. The goal is simple: make payments smarter, faster, and more seamless for both consumers and businesses.

While the move may sound technical, its implications are anything but. AP2 could reshape the way digital transactions happen, not just within Google’s ecosystem, but across the wider financial industry.

What Is Agent Protocol 2?

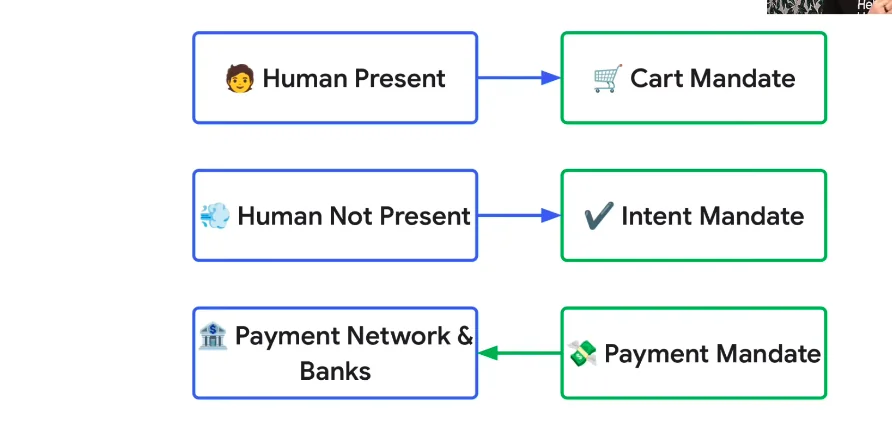

AP2 is Google’s latest attempt to bridge AI and payments. Using sophisticated AI agents, the protocol can:

- Automatically detect transaction patterns

- Suggest optimal payment methods

- Enable intelligent risk management in real-time

The protocol works across multiple platforms, including Google Pay and other partner services. By leveraging AI, Google aims to reduce friction, prevent fraud, and improve user experience—while giving businesses tools to automate complex payment workflows.

Why AP2 Matters

Digital payments are evolving rapidly. Consumers expect instant, reliable, and secure transactions. At the same time, businesses face growing pressure to manage payments efficiently across multiple channels.

AP2 addresses both sides of the equation. Its AI-driven approach allows systems to learn from user behavior, anticipate needs, and optimize the payment process. For Google, it’s a way to strengthen its foothold in fintech while offering tangible value to consumers and merchants alike.

Potential Industry Impact

Google’s entry into AI-enhanced payments could be a game-changer for the sector. Traditional payment processors often rely on fixed rules for risk management and fraud detection. AP2 introduces adaptability. The AI can respond dynamically to unusual behavior, potentially reducing fraud losses and increasing transaction success rates.

Furthermore, the protocol’s scalability makes it attractive for large enterprises. From subscription services to e-commerce giants, businesses could leverage AP2 to streamline operations and reduce costs.

Balancing Innovation and Privacy

As with any AI-driven financial system, data privacy and security remain top concerns. Google assures that AP2 adheres to strict privacy standards, anonymizing sensitive information and providing transparency in decision-making.

However, skeptics caution that increased AI oversight could introduce new risks. Misconfigured models or algorithmic biases might inadvertently affect transaction approval or denial. Google will need to continuously monitor and audit AP2 to maintain trust.

What Comes Next

AP2 is currently in pilot stages with select partners, with a broader rollout expected in 2026. Early tests reportedly show faster processing times, smarter transaction routing, and improved fraud detection.

Analysts suggest that if AP2 achieves scale, it could influence the broader payments ecosystem, pushing competitors like Apple Pay, PayPal, and Stripe to adopt similar AI-driven strategies.

For consumers, this could mean more seamless and personalized payment experiences. For businesses, it represents a new tool to optimize cash flow and reduce operational friction.

Final Thoughts

Google’s Agent Protocol 2 represents more than a technical upgrade—it’s a signal of how AI is shaping the future of finance. By combining machine learning, transaction intelligence, and scalability, AP2 could redefine digital payments.

While challenges remain around privacy and algorithmic oversight, the initiative is a bold step toward faster, smarter, and safer payments. Google’s move may not just innovate payments—it may set a new standard for the entire industry.

Resources:

https://www.linkedin.com/

https://knowledgenexuses.com/